RightPay: Our Prepaid Fuel Card

RightPay, our prepaid, pay-as-you-go fuel card, offers a flexible, secure, and cost-effective solution for businesses of all sizes, especially those with limited credit history.

RightPay, our prepaid, pay-as-you-go fuel card, offers a flexible, secure, and cost-effective solution for businesses of all sizes, especially those with limited credit history.

RightPay is our prepaid, pay-as-you-go fuel card that offers all the advantages of a traditional fuel card but without the credit terms. It’s ideal for newly registered businesses, companies with multiple agency drivers, and those with a less-than-perfect credit history looking to build their payment history with us.

You’ll benefit from fixed weekly diesel prices, one HMRC-approved bill for all transactions, and there’s no need to keep hold of receipts or manage expenses. Your 24/7 online account makes topping up your balance, managing fuel cards, and viewing and downloading invoices for your VAT reclaim easy. With RightPay, you also have full card control, enabling or restricting what can be purchased on each card.

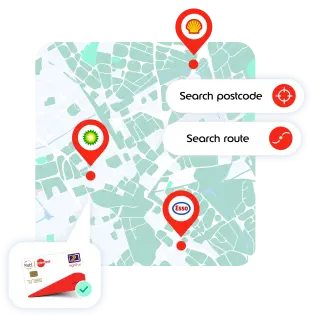

With access to the majority of the Keyfuels network of over 3,500 fuel stations nationwide, including almost 900 HGV-friendly locations, drivers have plenty of refuelling options, so they don’t have to worry about wasting time and money on detours, with RightPay providing access to over 70% of the UK motorway network.

Using a prepaid fuel card is easy. Simply top up your RightPay account balance online with a credit card or by bank transfer. You can then refuel at any participating station and pay using your RightPay fuel card. The funds will come out of your RightPay account balance, so always make sure you top up regularly to cover any purchases.

Refuel at 3,500+ stations, including motorways, and access over 900 HGV-friendly sites with high canopies and high-speed pumps.

Lock-in fixed weekly diesel prices, saving versus the standard pump price, with easy price alerts via text or email.

Ideal for startups or businesses with limited credit history, RightPay lets you build your payment history with us to move to weekly or monthly credit.

Secure transactions, PIN-protected cards and online monitoring reduce your fraud risk, with instant card deactivation for lost or stolen cards.

Consolidated HMRC-approved invoices eliminate receipt chasing, saving hours of managing receipts and expenses.

Restrict purchases to fuel, or enable additional purchases such as AdBlue, screen wash, and lubricant, giving you full spend control across all cards.

RightPay is accepted on the M6 Toll Road, making payment easy.

Earn loyalty points at participating stations, adding value for your drivers.

RightPay gives you a fixed weekly diesel rate across the network, helping you manage your fuel spend with confidence. Surcharges apply.

With more than 3,500 multi-branded sites available through the majority of the Keyfuels network, you’ll have access to refuelling points across the UK. Many sites are conveniently located near or on motorways, with almost 900 designed for HGV access, making it easy for both local and long-haul drivers to stay on route.

The RightPay card is perfect for diesel fleets of all sizes, from vans and LCVs to HGVs, especially for new businesses, companies with multiple agency drivers, or those that need a no-credit-check option. You can also bolt on extras like AdBlue, gas oil, lubricants, LPG, M6 toll payments, and car washes to keep vehicles running smoothly without extra admin.

Customer service fantastic couldn't do enough to explain how it all worked.

Olivia was very prompt in replying to my query via email and rang me back at a convenient time. The query was quickly resolved, calmly and with a friendly nature.

Great customer service. Rob is always very responsive and provides advice on the best card for our business.

From first enquiring it has been efficient, helpful and successful.

If you're unsure if our Rightpay prepaid fuel card is right for your business, read our frequently asked questions.

Our fuel cards help you make your fuel management more efficient and less time-consuming. Find out why you should choose Right Fuel Card or get in touch to learn more about how we can help you.

Of course, our team will be happy to give you all the information and advise you on the best fuel card for your business. Use our card finder tool to provide your details, and we'll give you a call back to discuss your options.

RightPay works on a top-up basis. You load funds into your account by card or bank transfer, and drivers use the fuel card at participating stations. Every purchase is taken from your prepaid balance, giving you total control over spending and unexpected fuel bills.

Yes! RightPay is specifically designed for startups and businesses with limited to no credit history. Because it is prepaid, it is a great choice for people wanting to build a payment history without the barriers of traditional cards.

RightPay lets you customise permissions for each card, so you can restrict purchases to only fuel or allow extras such as AdBlue, lubricants, or toll payments. Plus, instant online top-ups and real-time monitoring give you tight control over driver spend.

If you’re ready to get your RightPay prepaid, pay-as-you-go fuel card, easily apply online, or compare all our fuel cards if you're still unsure. Our team will call you back and is happy to help you find the right fuel card for your business.